- Former BitMEX CEO Arthur Hayes forecasts Bitcoin price will surge to $110,000 before a potential retrace to $76,500.

- Hayes cites the Federal Reserve’s shift from quantitative tightening (QT) to quantitative easing (QE) as a key catalyst.

- Bitcoin network activity is soaring, with active addresses up 15%, whale wallets increasing by 1.46%, and 6,040 BTC withdrawn from exchanges last week.

- BTC has broken out of a descending pattern, eyeing key resistance at $90,266 and a push higher to $109,396.

The Bitcoin price has jumped 3.9% in the last 24 hours to trade at $87,708 as of 6:50 a.m. EST on a 164% increase in trading volume to $18.5 billion.

The price increase happens in the backdrop of Arthur Hayes, the influential former CEO of BitMEX, predicting that BTC will soar to $110,000 before revisiting $76,500.

Hayes, known for his bold market calls, shared this forecast in a post on X on March 24, 2025, attributing the potential rally to the Federal Reserve’s shift from quantitative tightening (QT) to quantitative easing (QE).

Hayes pointed to Fed Chair Jerome Powell’s recent comments on “transitory inflation” as a key driver, suggesting that increased liquidity from QE will propel risk assets like Bitcoin higher. “The Fed is going from QT to QE for treasuries,” Hayes wrote, adding that he’ll elaborate in an upcoming essay.

On-chain data supports Hayes’ bullish outlook

As Bitcoin approached $88,000—up 3.9% in the last 24 hours—on-chain data and market dynamics lend credence to Hayes’ bullish outlook.

The Popular IntoTheBlock analytics (ITB) platform shows that active Bitcoin addresses with a balance have surged 15% over the past week to 53.4 million, marking a 30-day high. This signals growing network activity, which is a precursor to price rallies in past cycles.

Exchange netflows turned negative, with 6,040 BTC withdrawn from exchanges last week,comprising an 8.29% in exchange BTC inflow volume. This indicates accumulation by long-term holders and reduced selling pressure.

YCharts analytics also showed BTC transactions per day spiked to 533,755, a 66.15% jump from a monthly low of 264,912 on March 2. This reflects heightened market engagement.

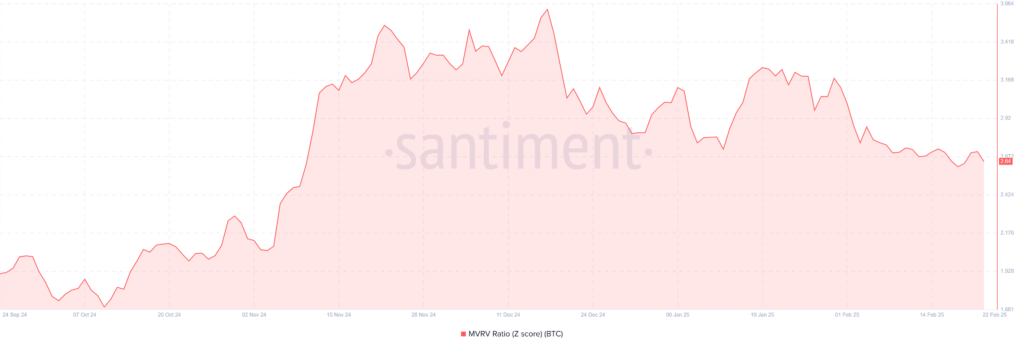

Further supporting the bullish case, Santiment data shows Bitcoin’s MVRV Z-Score sits at 2.61, well below the overbought threshold of 3.5, suggesting room for growth. The realized cap, which tracks the value of coins at their last moved price, rose 0.6 % in March to $865 billion, showing fresh capital entering the market.

Data from the Bitcoin Magazine analytics shows whale wallets holding over 1,000 BTC grew to 2,077, a 1.46% month-over-month increase. Similarly, the network’s hash soared to 818 EH/s, up 10% in the last month, reflecting miner confidence.

Bitcoin price defies bearish reversal, eyes $90,254 key breakout

BTC price recently followed a descending arc pattern, indicating a potential rounded top formation, which is a typical bearish reversal pattern. However, the price has broken out of a downward channel after Bitcoin jumped 3.7% on March 23, suggesting a shift in momentum.

BTC is currently approaching the 50-day simple moving average (SMA) at $90,266, which represents a key resistance level. The recent bullish candles suggest buying pressure is increasing, as confirmed by on-chain analysis. If it breaks above this level, Bitcoin price may surge 21% to $109,396, which marks the previous all-time high.

Conversely, if market conditions turn bearish, BTC may find support at the current price range of $85,000 – $86,000. A deeper correction may send the asset lower to $81,000, where a stronger support level exists.

What’s Next for Bitcoin Price?

Hayes’ prediction aligns with Bitcoin’s current momentum, which has seen the leading cryptocurrency climb steadily, fueled by institutional adoption. Michael Saylor’s MicroStrategy, for instance, now holds 499,226 BTC, with US spot Bitcoin ETFs recording $744 million in net inflows last week, including $537 million from BlackRock alone.

However, caution lingers. The futures market funding rate, at 0.02%, hints at over-leverage, which could trigger short-term pullbacks. Still, with the Fed’s dovish stance—keeping rates at 4.25-4.50% and signaling potential cuts—Hayes’ $110,000 target looks increasingly plausible. For now, Bitcoin’s on-chain strength and institutional backing keep the bulls in the driver’s seat.